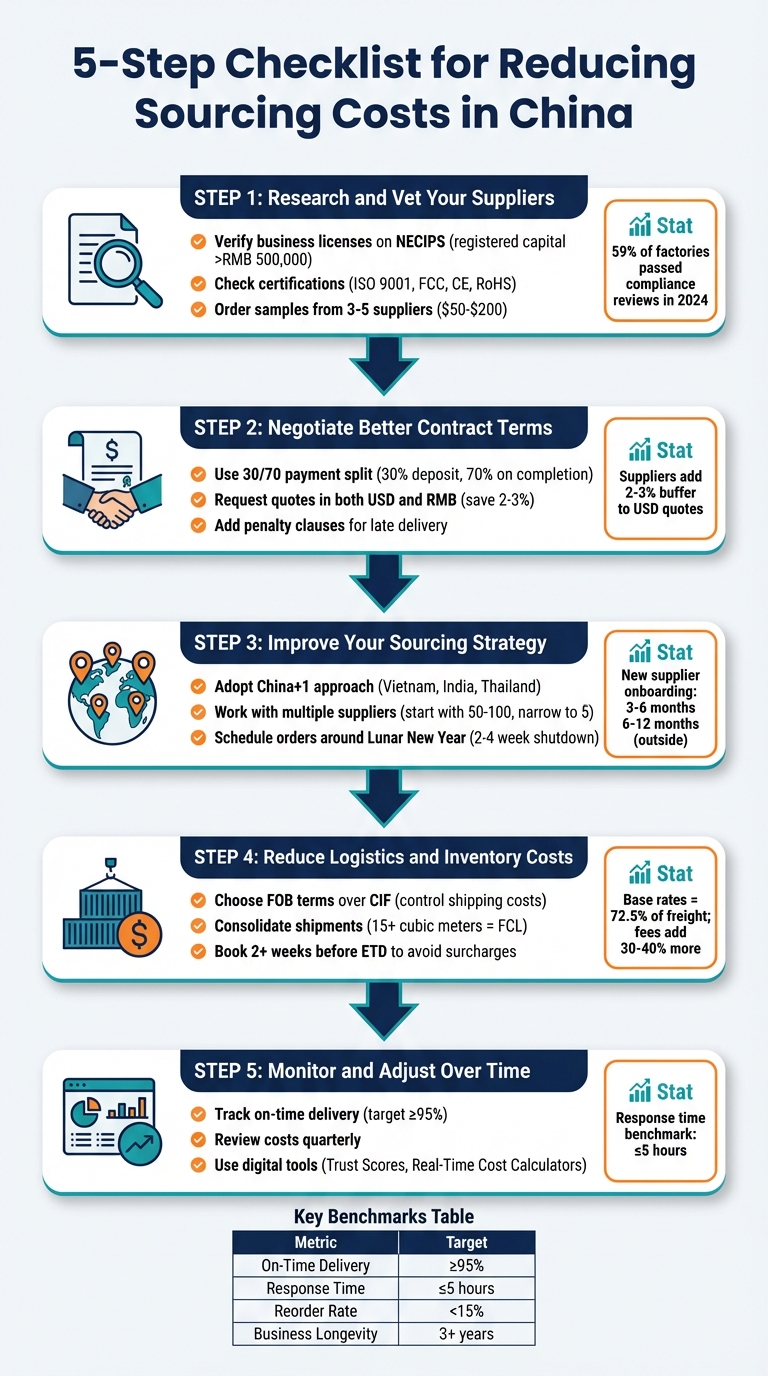

Want to cut sourcing costs in China? Start here.

Sourcing from China offers opportunities, but hidden costs like shipping, tariffs, and quality issues can eat into your margins. To save money without sacrificing quality, follow these steps:

- Verify suppliers: Check licenses, certifications, and factory credentials to avoid fraud.

- Negotiate smarter: Break down costs, use payment terms like 30/70 splits, and avoid full upfront payments.

- Diversify sourcing: Use a China+1 approach (e.g., Vietnam, India) to reduce risk.

- Optimize logistics: Choose FOB terms, consolidate shipments, and book early to avoid peak costs.

- Track performance: Monitor suppliers regularly to ensure reliability and avoid costly delays.

These strategies help you calculate your total landed cost, avoid expensive mistakes, and build a resilient supply chain.

5-Step Checklist for Reducing China Sourcing Costs

The Death of China-Only Sourcing | I Explain Why

sbb-itb-633367f

Step 1: Research and Vet Your Suppliers

This step involves verifying documents, analyzing costs, and using digital tools to ensure your supplier is reliable.

Check Supplier Credentials

Start by verifying the supplier's business license (营业执照), which includes details like the Unified Social Credit Code, registered capital, legal representative, and business scope. Cross-check this information on the National Enterprise Credit Information Publicity System (NECIPS), China’s official government database. Pay close attention to the registered capital - if it’s under RMB 500,000 (around $70,000), you’re likely dealing with a trading company rather than a manufacturer.

Look for specific terms in the business scope. Words like "production" or "manufacturing" signal a factory, while "wholesale" or "trade" often point to a middleman. Also, verify the supplier’s location. For example, electronics are typically produced in Shenzhen, textiles in Zhejiang, and socks in Zhuji. Suppliers outside these industrial hubs are often traders.

Request certifications relevant to your market. For example:

- ISO 9001 for quality management systems

- FCC or UL for U.S. compliance

- CE for European standards

- RoHS or ISO 14001 for environmental compliance

According to QIMA, 59% of factories audited in China in 2024 passed compliance reviews. This step is critical because fixing compliance issues later can be costly or impossible.

Ensure the bank account beneficiary name matches the English name on the business license to avoid payment fraud. Also, ask for a VAT invoice - only legitimate manufacturers can issue these to claim government export rebates. If a supplier can’t provide one, that’s a major red flag.

By verifying these credentials, you reduce risks and set the stage for efficient cost management. Once you’ve validated the supplier’s legitimacy, move on to comparing pricing and product quality.

Compare Pricing and Quality

The factory price is just one part of the equation. You need to calculate your total landed cost, which includes the FOB price, shipping, and customs duties. For instance, a $4.20 factory price might rise to $6.55 after adding customization, freight, and a 25% tariff.

Order samples from 3–5 potential suppliers and evaluate them side by side. Assess materials, dimensions, finish quality, and performance. Spending $50–$200 on custom prototypes can save you from costly production mistakes. As Kanary advises:

A $300 sample order prevents a $30K production failure. Never skip this step, even with 'trusted' suppliers.

Ask for a detailed cost breakdown, covering materials, labor, packaging, and freight. This will help you identify areas where suppliers might be cutting corners or overcharging. Avoid chasing the lowest price - pressuring suppliers too much can lead to "quality fade", where cheaper materials are used over time. Instead, focus on negotiating better terms, such as:

- Payment terms (e.g., 30% deposit, 70% after quality control)

- Extra units to cover defects

- Improved packaging

Track key performance metrics like on-time delivery rates (aim for over 95%) and reorder rates (target above 30%). These figures can reveal whether other buyers trust the supplier enough to return for repeat orders.

Once you’ve compared costs and quality, leverage data tools for a deeper dive into supplier reliability.

Use Data Tools to Assess Supplier Reliability

Platforms like Alibaba and Global Sources provide badges such as "Verified Supplier" or "Gold Supplier", indicating that third parties have audited the supplier’s identity and capabilities.

For more detailed verification, tools like ForthSource offer a Trust Score (0–100), which evaluates factors like verified business licenses, transaction volumes, response rates, and customer reviews. This score helps you quickly gauge whether a supplier is legitimate or risky. Premium members can also use features like the Real-Time Landed Cost Calculator, which estimates shipping costs, duties, and taxes to give you the full cost before contacting the supplier. Enterprise users gain access to Baidu Intelligence Reports, which verify a factory’s legitimacy within China itself, not just on its English-facing profile.

Third-party inspection services, including SGS, Bureau Veritas, and TÜV, conduct on-site audits to assess production capacity, machinery condition, and quality control systems. These audits typically cost $250–$400 per visit and include detailed reports with photos. Additionally, financial credit agencies like Dun & Bradstreet and Experian provide insights into a supplier’s creditworthiness, revenue, and financial stability.

Fredrik Gronkvist, Co-founder of Asiaimportal, highlights the importance of using data:

A supplier selection without the right data is often the root cause of quality issues further down the road.

A response time under 12 hours is another key indicator of a supplier’s organizational efficiency. By combining tools like ForthSource and third-party audits, you can confidently verify a supplier’s legitimacy and reliability.

Step 2: Negotiate Better Contract Terms

After verifying your supplier's credentials and comparing prices, the next move is to lock in contract terms that protect your profit margins and minimize hidden expenses.

Negotiate Pricing and Payment Terms

Start by asking for a detailed cost breakdown. This transparency can help you pinpoint areas for negotiation, such as inflated labor costs or potential volume discounts.

Avoid paying the full amount upfront. For orders under $10,000, a 30/70 payment split - 30% as a deposit and 70% upon completion - works well. For larger or higher-risk orders, consider a 30:40:30 structure: 30% down, 40% after inspection or shipping, and 30% upon receipt. This staged payment plan keeps you in control of quality and delivery timelines.

Currency choice is also key. Many Chinese suppliers add a 2% to 3% buffer to USD quotes to account for exchange rate fluctuations. Request quotes in both USD and RMB to avoid unnecessary markups. As Sourcing Allies explains:

Any payment arrangement that reduces the cost of currency hedging for your manufacturer can translate into more favorable pricing for you.

Be specific about when the balance payment is due. Clarify whether it’s after production, post-quality inspection, or upon receiving a Bill of Lading (BL) copy. Never release the final payment until a third-party quality inspection report is approved. Additionally, negotiate tiered pricing upfront so unit costs automatically decrease as your order volumes increase.

These steps ensure you’re not just getting a good deal but also safeguarding your investment.

Add Cost-Control Clauses to Contracts

Your contract should include clauses that cap price increases and penalize delivery failures. Specify that you have the right to reject orders if the supplier tries to change agreed-upon terms. For consistent order volumes, consider working with a lawyer to draft an OEM agreement that locks in pricing based on a predictable formula.

To further protect yourself, include penalty clauses for late deliveries or subpar quality. These clauses can shield you from indirect costs like lost sales or expedited shipping fees. As Renaud Anjoran, CEO of Sofeast Group, highlights:

The advantage of a letter of credit is that you don't get 'hooked' by a 30% down payment (which is never ever sent back by a supplier to a customer).

Make sure your contract is written in both English and simplified Mandarin Chinese to prevent misunderstandings during disputes. For the contract to hold up in Chinese courts, it must include a verified company chop (gōngzhāng) and wet-ink signatures - electronic signatures are often not enough. If the stakes are high, investing around $5,000 in legal fees for professional verification of the company’s official seal could save you from costly disputes later.

Finally, use Incoterms wisely. Opting for "Free on Board" (FOB) terms allows you to manage international freight and avoid supplier-imposed markups tied to "Cost, Insurance, and Freight" (CIF) terms.

Reduce Payment Processing Costs

Choosing the right payment method can significantly cut fees. Telegraphic Transfer (TT) is the go-to option for mass production, offering lower fees compared to PayPal, which charges 2.9% to 4.4% plus transaction fees. Reserve PayPal for small sample orders, as its fees become unmanageable for larger transactions.

Clearly define in your contract who covers bank fees. Hidden SWIFT fees from intermediary banks often lead to disputes when deducted from the supplier’s final payment. To avoid high markups, use online currency brokers like Wise or OFX, which provide mid-market exchange rates.

Consider using forward contracts to lock in exchange rates for up to 12 months. Always verify bank details directly - via phone or video call - to reduce the risk of fraud.

| Payment Method | Fees/Costs | Best Use Case |

|---|---|---|

| Telegraphic Transfer (TT) | Fixed bank fee + intermediary fees + 1–3% FX spread | Mass production |

| Wise Business | Mid-market rate (no markup) + small transparent fee | Frequent transfers, cost-effective FX |

| PayPal | 2.9% to 4.4% + currency conversion loss | Small samples or initial orders |

| Letter of Credit (LC) | High bank opening fees + complex paperwork costs | Very large orders (>$50,000) |

Paying in RMB can also lower costs by bypassing the supplier’s currency hedging fees. Online networks like Veem report that Chinese suppliers receive 1% to 2% more funds when paid in RMB compared to USD conversions through traditional banks.

Step 3: Improve Your Sourcing Strategy

Once your contracts are finalized, it’s time to take a proactive approach to sourcing. Relying on a single supplier or region can leave your business exposed to sudden disruptions that could drive up costs overnight. By diversifying your sourcing strategy, you not only reduce risks but also build a more resilient supply chain that’s better equipped to handle future challenges.

Consider a China+1 Sourcing Approach

Diversifying beyond China doesn’t mean cutting ties with it completely. The China+1 strategy allows you to maintain your primary production base in China while setting up additional manufacturing operations in countries like Vietnam, India, or Thailand. This approach helps you navigate tariff changes and localized disruptions while still benefiting from China’s well-established infrastructure.

For example, Apple began shifting some production to Vietnam in 2022 and quickly launched iPhone 14 production in India, reducing its reliance on China from 95% to a projected 75% by 2025. Foxconn, Apple’s manufacturing partner, took significant steps by leasing over 50 hectares of land in Vietnam to build a factory expected to create 30,000 jobs.

Another case: A global kitchenware company flipped its production ratio from 80% in China and 20% in Vietnam to the reverse by 2025. This strategic move allowed them to sidestep cost increases when new tariffs were introduced later that year.

If you're considering similar steps, start small. Pilot projects are a great way to test the waters - begin with low-complexity product lines or small test batches in a new location. This allows you to validate quality before committing to large-scale production. Be prepared, though; establishing a reliable alternative production base can take anywhere from 12 to 30 months.

Here’s a quick look at some potential sourcing destinations and their strengths:

| Country | Key Industry Strengths | Primary Advantage |

|---|---|---|

| Vietnam | Electronics, textiles, footwear, furniture | Competitive labor, proximity to China |

| India | Pharmaceuticals, auto components, electronics | Large skilled labor pool, market size |

| Thailand | Automotive, electronics | Strong infrastructure, "Thailand Plus" incentives |

| Mexico | Automotive, electronics, medical devices | Close to the U.S. market (Nearshoring) |

| Malaysia | Semiconductors, electronics | Skilled workforce, established tech base |

Work with Multiple Suppliers

Working with multiple suppliers isn’t just about spreading risk - it also gives you leverage. When suppliers know they’re competing for your business, they’re more likely to offer better prices and maintain higher quality standards.

However, don’t just focus on unit price. Compare total landed costs, which include defect rates and rework expenses. Start by identifying 50 to 100 potential suppliers, then narrow it down to five for sample testing and final negotiations. Order 5 to 10 samples from each of these top candidates to ensure they’re not just sending you a single, flawless “golden sample”.

Even if they’re not actively producing for you, keep 2nd and 3rd tier backup suppliers on standby. These backups act as insurance, whether for domestic operations or China+1 strategies. Keep in mind that onboarding a new supplier within China typically takes 3 to 6 months, while setting up alternatives outside China can require 6 to 12 months.

Digital tools like ForthSource can speed up the process, offering instant access to Alibaba suppliers ranked by reliability. ForthSource’s Trust Score helps you quickly identify credible options, compare pricing, and review quality metrics.

Once your supplier network is in place, adjust your operations to account for seasonal patterns and tariff changes.

Schedule Orders Around Seasonal Downtime and Tariff Adjustments

Chinese factories typically shut down for 2–4 weeks during Lunar New Year. Additionally, demand for shipping containers spikes around major holidays, which can lead to delays of several weeks or even months if bookings aren’t made early.

To stay ahead, place orders well before the Lunar New Year shutdown to ensure production timelines are met. Similarly, book shipping containers weeks in advance during the holiday season to avoid inflated costs and delays.

Tariff management is just as critical. For instance, in late September 2025, the U.S. imposed new tariffs on various sectors, including branded pharmaceuticals (100%), kitchen cabinets (50%), upholstered furniture (30%), and heavy trucks (25%). Earlier that year, in April, tariffs as high as 104% were applied to certain Chinese goods.

To protect your margins, negotiate a "valid until" period for price quotes - ideally 180 days. This shields you from sudden raw material cost increases or currency fluctuations. Additionally, include a price limiter clause in contracts to prevent unexpected price hikes over time.

Finally, ensure accurate classification of goods using HTS codes. Incorrect codes can raise duties by 20–30%, and intentional misclassification can result in penalties equal to 100% of the order value. Proper tariff management directly impacts your bottom line, making it a key part of maintaining cost efficiency.

Step 4: Reduce Logistics and Inventory Costs

Shipping and inventory expenses have a direct impact on profit margins. Base rates alone account for around 72.5% of total freight charges, but additional fees - like detention, liftgate services, and handling - can tack on another 30–40%. That’s why managing your shipping and inventory strategically can make a big difference to your bottom line.

Lower Your Shipping Costs

Once you’ve locked in supplier agreements and negotiated contracts, the next step is cutting logistics costs. Start by choosing the right shipping method. For shipments over 500 kg, sea freight is the most economical choice. For loads between 150–500 kg, air freight costs roughly $3 per kg. If you’re dealing with urgent samples under 150 kg, express freight is quicker but pricier, at about $5 per kg. For context, air freight from China to the U.S. typically takes 8–10 days, while sea freight stretches to 30–40 days.

Selecting the right Incoterms is equally important. Opt for FOB (Free on Board) instead of CIF (Cost, Insurance, and Freight). With FOB, you control the shipping process from the departure port onward, allowing you to shop around for better rates at your destination. This flexibility can lead to significant savings.

Consolidating shipments is another effective strategy. Once your cargo reaches about 15 cubic meters, it’s often more cost-effective to book a full 20-foot container (FCL) instead of shipping via Less than Container Load (LCL). Consolidating smaller orders into a single FCL shipment reduces per-unit costs and avoids extra handling fees. Partnering with a local freight forwarder in China can also help, as they often have access to lower labor costs and regional carrier discounts.

Don’t overlook packaging. Carriers calculate charges based on dimensional weight, so optimizing carton sizes and using lightweight materials can help reduce costs. Regularly auditing your freight bills can also help recover 1–5% of your total freight spend.

"Every dollar saved in transportation translates to an equal improvement in financial performance."

Timing can also save you money. Book shipments at least two weeks before the Estimated Time of Departure (ETD) to lock in lower rates and avoid peak surcharges. Steer clear of shipping during Chinese New Year, when reduced capacity drives up costs for about three weeks.

Optimize Inventory Levels

Shipping costs are only part of the equation. Efficient inventory management is just as crucial for keeping expenses in check. Poorly managed inventory can tie up working capital and inflate operating costs. Striking the right balance between just-in-time (JIT) delivery and maintaining a buffer stock is key to avoiding both overstocking and stockouts. Demand forecasting tools can help you determine the right safety stock levels to meet customer needs without over-investing.

Reducing lead times is another way to trim inventory costs. Shortening supplier lead times or transportation cycles can permanently reduce the amount of stock you need on hand. Many reliable Chinese suppliers offer production lead times of 30–60 days after deposit confirmation, so it’s worth negotiating these timelines upfront.

Another smart tactic is postponement. By storing semi-finished products or components and completing final assembly only after receiving orders, you can reduce inventory costs while staying flexible to market demands. Simplifying your inventory by eliminating low-margin or underperforming SKUs can also help streamline operations and cut costs.

Negotiating better payment terms can further improve cash flow. For example, aim for a 30% deposit and pay the remaining 70% upon delivery. This reduces the amount of capital tied up in inventory. Using Sales and Operations Planning (S&OP) can also align your production capacity with actual demand, ensuring you’re not overcommitting resources.

When paired with smart strategies for duties and taxes, these inventory and shipping optimizations can deliver even greater savings.

Reduce Import Duties and Taxes

Managing import duties and taxes is another critical aspect of controlling overall costs. These fees can add anywhere from 5–40% to the landed cost of goods from China. Accurate HS code classification is essential here. Even a small error in an HS code can raise the duty rate significantly - sometimes from 0% to 12%. Intentional misclassification, meanwhile, can lead to penalties as high as 100% of the order value.

Using FOB terms can also help lower duties, as they calculate taxes based solely on the product cost, excluding international shipping and insurance. By contrast, CIF terms include these additional costs in the taxable base, resulting in higher duties.

"FOB (Free On Board) is generally the best choice for importers because it gives you control over your logistics and keeps your customs valuation lower."

Another option is the First Sale Rule (FSR), which allows you to base duty calculations on the price paid during the "first sale", such as from the factory to a middleman, rather than the final price you pay as the importer. However, this requires detailed documentation, so working with a customs broker is highly recommended to ensure compliance.

Don’t overlook duty drawback programs. U.S. businesses can recover up to 99% of duties, taxes, and fees paid on imported goods if those goods are later exported or destroyed. Additionally, using the Automated Commercial Environment (ACE) system to review past entries can help identify missed opportunities, such as unclaimed Special Program Indicators (SPI) or classification errors.

For smaller e-commerce shipments under $800, Section 321 Type 86 entries can speed up customs clearance and eliminate duties under the de minimis exemption. Lastly, consider using Foreign Trade Zones (FTZs) or bonded warehouses. These facilities allow you to defer, reduce, or even eliminate duties until goods are either sold domestically or re-exported.

Step 5: Monitor and Adjust Over Time

Reducing costs isn’t a one-time effort - it’s an ongoing process that requires consistent tracking and adjustments as market conditions and supplier performance shift.

Track Supplier Performance

After negotiating costs and optimizing logistics, it’s crucial to maintain supplier reliability through regular performance monitoring. This helps you identify and address potential issues early. For high-volume contracts, establish a regular review schedule. For smaller-scale partnerships, conduct special assessments when warning signs arise, such as late deliveries, quality issues, or signs of financial instability.

A three-tier review system can help ensure thorough oversight:

- Operational reviews: These include on-site visits or virtual tours to inspect machinery, inventory levels, and production capacity.

- Procedural reviews: Evaluate suppliers’ risk management systems, like Process Failure Mode and Effect Analysis (P-FMEA), to ensure they’re prepared for potential disruptions.

- Administrative reviews: Check legal documents, business licenses, and shareholder structures to confirm the supplier’s long-term stability.

Supplier scorecards can be a valuable tool for tracking performance across key areas like quality, cost, delivery, communication, and innovation. Set clear benchmarks to measure success, such as maintaining an on-time delivery rate of 95% or higher, a response time under 5 hours, and a reorder rate (buyer churn) below 15%.

"Supplier vetting is not a one-and-done activity. It's a continuous process of setting the right standards, monitoring performance, evolving with your business, and staying ahead of supply-chain risk." - Sourcify

For example, in 2021, Dezan Shira & Associates helped a company struggling with a Chinese supplier. The supplier had cited financial troubles, demanded steep deposits, and delayed shipments. An operational review revealed that only half of the reported products were packed, with material shortages causing the delays. This discovery allowed the company to renegotiate a realistic delivery plan and rebuild trust with the supplier using objective data.

Review Costs Regularly

Cost management doesn’t end with logistics and contracts. To protect profitability, reassess all cost components - like landed costs - on a regular basis. A quarterly review of supplier pricing, shipping fees, and production expenses can help you identify trends and avoid overpaying.

Don’t just focus on unit prices. Compare shipping terms like FOB (Free on Board) and EXW (Ex Works) to find the most economical options for transportation and insurance. Even small changes can lead to noticeable savings over time.

It’s also wise to monitor suppliers’ financial health. Request financial statements periodically or use credit agencies like Dun & Bradstreet to assess their creditworthiness. Suppliers facing financial difficulties may cut corners on quality or delay shipments, which could cost you more in the long run.

Use Technology to Stay Informed

Technology can make supplier and market monitoring more efficient by providing real-time insights. Modern sourcing platforms offer data on supplier reliability, pricing trends, and market shifts, helping you make informed decisions quickly.

For instance, ForthSource aggregates Alibaba suppliers and assigns a Trust Score based on verified licenses, transaction volumes, response rates, and customer reviews. This simplifies the process of identifying reliable suppliers. Premium users can access tools like a Real-Time Landed Cost Calculator to estimate shipping costs and import duties upfront, while Enterprise users benefit from Baidu Intelligence Reports, which verify the legitimacy of Chinese factories for high-value orders.

In addition to supplier discovery, project management tools like Trello or Asana can help you track export timelines and assign responsibilities. Many suppliers now use IoT-enabled production lines, also known as Digital Twins, which allow you to monitor manufacturing progress in real time without traveling. This level of visibility helps you catch delays or quality issues before they escalate.

| Metric | High-Performance Benchmark | Why It Matters |

|---|---|---|

| On-Time Delivery | ≥95% | Ensures smooth inventory management and keeps customers satisfied |

| Response Time | ≤5 hours | Demonstrates strong communication and service standards |

| Reorder Rate (Churn) | <15% | Reflects supplier reliability and consistent product quality |

| Business Longevity | 3+ years | Indicates operational stability and a proven track record |

Conclusion: Your Cost Reduction Checklist Summary

Review of the Checklist Steps

Reducing sourcing costs in China isn't just about cutting corners - it’s about following a structured plan before you even place an order. This checklist breaks it down into five key areas: vetting suppliers with verified credentials and licenses, negotiating contracts that safeguard your margins with better payment terms and defect coverage, refining your sourcing strategy through diversification and timing, lowering logistics costs with smart Incoterms and inventory planning, and tracking performance through regular reviews and data-driven analysis.

Each step builds on the last. For instance, having clear product specifications upfront helps avoid expensive rework later. Using a "Funnel Sourcing" method - starting with 50–100 suppliers and narrowing it down to the top five based on credentials rather than just price - sets the stage for sustainable savings. Price benchmarking on platforms like 1688.com can give you an edge in negotiations, while pre-shipment inspections and small trial runs (10–30% of your full order) catch issues before they escalate into costly mistakes.

"If you pressure suppliers to lower price too much, they will find a way to recoup that lost profit by using lower quality raw materials." - Guided Imports

These steps aren’t just about cost-cutting - they’re about building a sourcing strategy that improves over time.

How Technology Supports Cost Reduction

Modern technology takes a lot of the guesswork out of supplier management and cost reduction. Instead of manually verifying business licenses on NECIPS or scanning endless Alibaba listings, data-driven platforms now aggregate supplier information and assign reliability scores based on verified credentials, transaction volumes, and customer feedback.

For example, ForthSource simplifies supplier vetting with its Trust Score, which is built on verified credentials and transaction data. Premium users can take advantage of its Real-Time Landed Cost Calculator to estimate shipping fees and import duties upfront, while Enterprise users benefit from Baidu Intelligence Reports that validate factory legitimacy using domestic Chinese data sources. This level of transparency helps you avoid hidden costs and unreliable vendors.

By integrating these tools into your process, you can save time and focus on optimizing your sourcing strategy further.

Keep Improving Your Sourcing Process

Cost reduction isn’t a one-and-done effort - it’s a continuous process. Market dynamics change, suppliers’ financial situations evolve, and new logistics options become available. Regularly reviewing supplier costs and logistics ensures you stay ahead.

Adopting a China+1 strategy - maintaining backup suppliers in other regions - can protect your business from regional disruptions. Regular audits, whether in-person or through virtual factory tours, help ensure that suppliers stick to the standards you expect. Successful businesses don’t treat suppliers as one-off transactions; they see them as long-term partners. Revisiting and refining each part of this checklist over time strengthens your sourcing strategy and keeps you ready for whatever challenges the market throws your way.

FAQs

What steps can I take to verify a supplier in China and avoid scams?

Verifying a supplier’s credentials is a key step to safeguard your business from potential fraud. Start by requesting their business license and cross-checking key details - such as the company name, registration number, and address - against the National Enterprise Credit Information Publicity System (NECIPS), China’s official database for registered businesses. This will help confirm that the company is active and hasn’t faced recent penalties. Additionally, review their corporate registration and tax certificates for further assurance.

If the supplier claims to be a manufacturer, ask for a factory audit report or consider arranging a third-party inspection to confirm their operational capabilities. To dig deeper into their reliability, conduct a credit and reputation check. This involves examining their credit rating, payment history, and any records of legal disputes. You can also check their credibility by reviewing transaction history and activity on platforms like WeChat or Alibaba.

For a quicker, data-backed evaluation, services like ForthSource can be incredibly helpful. These platforms use advanced scoring systems to assess suppliers based on factors like pricing, credibility, and legal records, giving you the tools to make more informed and secure sourcing decisions.

What are the advantages of adopting a China+1 sourcing strategy?

A China+1 sourcing strategy means expanding your supplier network by including at least one other country outside of China. This approach aims to reduce dependence on a single region and tackle risks like supply chain interruptions, rising labor expenses, or geopolitical challenges.

By spreading sourcing across multiple regions, companies can often cut costs, strengthen supply chain stability, and tap into a wider variety of materials or products. It also positions businesses to respond more effectively to shifting market conditions while keeping pricing competitive and quality consistent.

What are the best ways to lower shipping and logistics costs when sourcing from China?

To trim shipping and logistics costs when sourcing from China, try these practical approaches:

- Consolidate shipments into full-container loads (FCL). This can lower your per-unit shipping costs by maximizing container usage.

- Choose sea freight over air freight whenever feasible. While slower, it’s far more economical for large orders.

- Streamline your packaging to make the most of container space and avoid paying for unused volume.

- Negotiate freight rates and Incoterms with your freight forwarder. A little back-and-forth can lead to better pricing and terms.

- Partner with a Chinese warehouse or fulfillment service. This can simplify last-mile delivery and reduce transit distances.

By implementing these strategies, you can save money and make your supply chain more efficient.