If you're importing goods from Alibaba into the U.S., here's what you need to know:

- Most products don’t require an import license. Everyday items like clothing, electronics, and home goods can usually be imported without one.

- Regulated goods do need permits. Items like food, cosmetics, medical devices, firearms, and chemicals require approval from federal agencies such as the FDA, EPA, or USDA.

- You always need an importer number. This can be your IRS EIN, Social Security number, or a CBP-assigned number.

- Proper documentation is critical. Key paperwork includes a Commercial Invoice, Packing List, Bill of Lading, and Certificate of Origin.

- Shipments under $800 qualify for Section 321. This allows duty-free imports without formal customs clearance.

To ensure compliance, identify your product's HS code, verify regulatory requirements, and double-check your documents. For complex shipments, consider hiring a licensed customs broker.

When You Don't Need an Import License

Products That Don't Require Import Licenses

Here's some good news: most consumer goods from Alibaba can enter the U.S. without needing a formal import license. According to USA.gov, "In most cases, you will not need a license to import goods into the U.S.". This applies to a wide range of everyday items like clothing, accessories, home décor, and electronics.

Import licenses or permits are only required for products overseen by specific federal agencies. These include items like pharmaceuticals, chemicals, beauty products, and military goods. However, regardless of the type of product, every shipment still needs an importer number - usually your IRS EIN or Social Security number. It's also crucial to ensure all customs documentation is accurate and complete.

Required Documents for Customs Clearance

Even if an import license isn't necessary, you'll still need to provide the right paperwork to get your shipment through U.S. Customs.

U.S. Customs and Border Protection (CBP) requires certain documents to clear your shipment, and you must file the necessary entry forms within 15 days of your shipment's arrival at a U.S. port of entry. The key documents include:

- Commercial Invoice: Used to determine customs value and duties.

- Packing List: Details the contents of the shipment.

- Bill of Lading or Airway Bill: Serves as proof of shipment.

- Certificate of Origin: Verifies where the goods were produced.

For smaller orders, there are even more perks. Shipments valued at $800 or less qualify for Section 321, which exempts them from formal customs clearance and duty payments. And if you don’t have an EIN, you can use your Social Security number or request a CBP-assigned number by filling out CBP Form 5106 and submitting it to a port of entry.

How to Handle Customs Documentation on Alibaba | Step-by-Step Guide 2026

When Import Licenses Are Required

U.S. Import License Requirements by Product Category

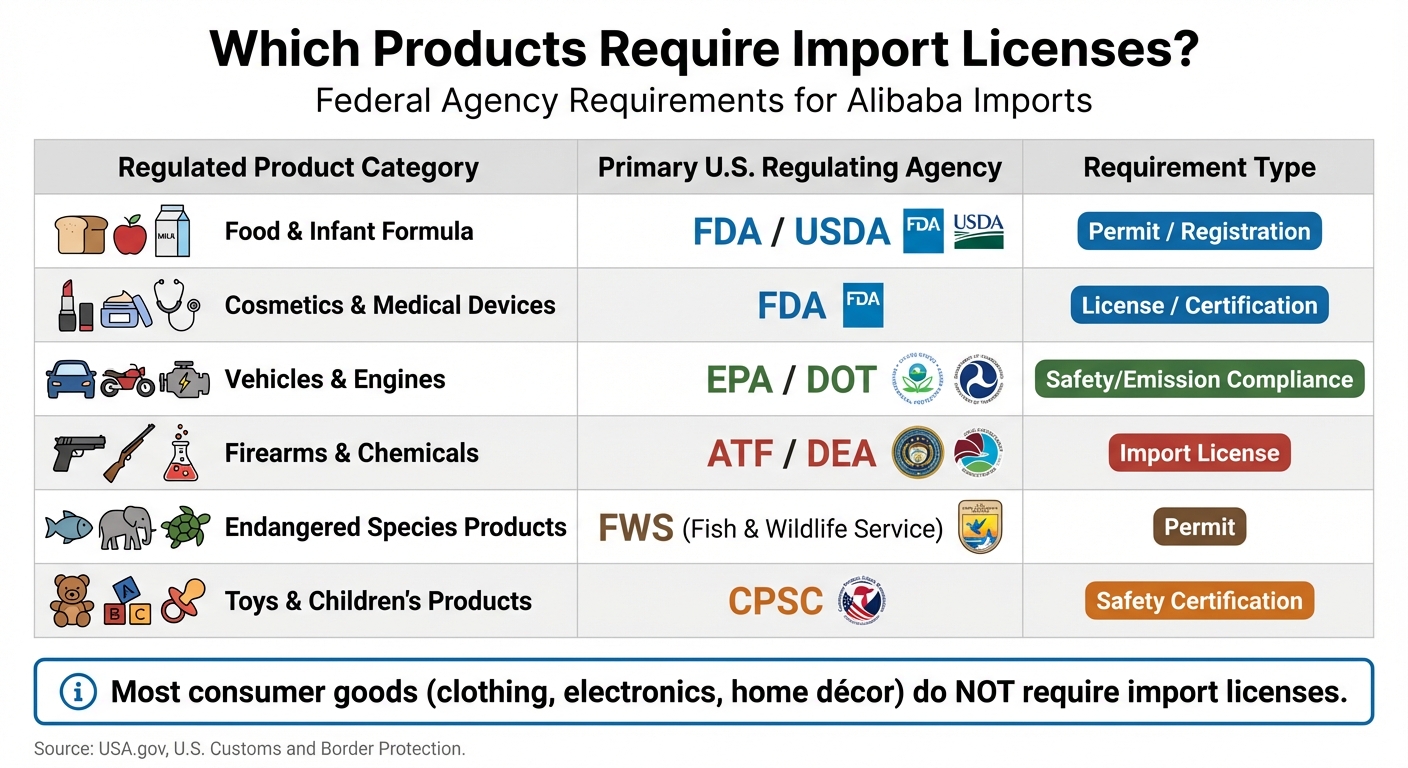

Products That Require Import Licenses

While most consumer goods pass through customs without much hassle, some product categories demand specific federal oversight. These regulations exist to ensure public health, safety, and national security.

Food and agricultural products are tightly regulated by the FDA and USDA. This includes items like grains, oilseeds, live seafood, infant formula, and health foods. Suppliers in countries like China must comply with both Chinese export laws and U.S. import standards.

Health and beauty products - such as pharmaceuticals, medical devices, and cosmetics - often require FDA registration or permits. Similarly, vehicles and industrial equipment, including trucks, engines, and commercial aircraft, must meet EPA and DOT standards. Controlled goods, like firearms, ammunition, certain chemicals, and products made from endangered species, require strict licensing from agencies such as the ATF, DEA, and Fish & Wildlife Service. Even consumer safety items, like toys and specific electronics, must meet CPSC safety standards.

| Regulated Product Category | Primary U.S. Regulating Agency | Requirement Type |

|---|---|---|

| Food & Infant Formula | FDA / USDA | Permit / Registration |

| Cosmetics & Medical Devices | FDA | License / Certification |

| Vehicles & Engines | EPA / DOT | Safety/Emission Compliance |

| Firearms & Chemicals | ATF / DEA | Import License |

| Endangered Species Products | FWS (Fish & Wildlife Service) | Permit |

| Toys & Children's Products | CPSC | Safety Certification |

If you're importing any of these items, make sure to confirm the exact requirements based on your product category.

How to Check If Your Product Needs a License

Start by identifying your product's Harmonized System (HS) code. This code helps uncover tariff rates and determines whether your product falls under specific regulatory requirements. Once you have the HS code, cross-check it with U.S. Customs and Border Protection (CBP) guidelines to figure out which federal agency regulates your product.

For free guidance, reach out to CBP Centers of Excellence. You can also contact the relevant agency - such as the FDA, EPA, or CPSC - for application forms and detailed procedures. If your shipment is valued under $800, look into Section 321 exemptions. Finally, when ordering from suppliers (e.g., on Alibaba), always request compliance documents and certifications, especially for regulated goods.

"In most cases, you will not need a license to import goods into the U.S. But for some items, agencies may require a license, permit, or other certification." - USA.gov

sbb-itb-633367f

How to Determine Import License Needs (U.S. Importers)

Step 1: Find Your Product's HS Code

The Harmonized System (HS) code is the key to understanding the regulations that apply to your Alibaba order. This code classifies your goods for customs purposes and determines the duties and taxes you'll need to pay. Typically, your Alibaba supplier will include the HS code on the commercial invoice, but it’s a good idea to request it early during the quoting process. This helps you calculate your total landed costs before committing to a purchase.

However, don’t rely solely on your supplier’s HS code. Suppliers can sometimes misclassify goods, and tariff rates differ across countries. To avoid issues, consult a licensed customs broker who can verify the HS code for accuracy. This step can save you from customs delays and unexpected charges.

"The broker will find the correct tariff via a customs code lookup based on the description of your goods." - Alibaba.com

Ensure that your commercial invoice clearly lists prices, quantities, detailed descriptions, and the HS code. This will make customs clearance smoother. Once your HS code is confirmed, you can move on to identifying which regulatory agencies oversee your product.

Step 2: Check With Regulatory Agencies

After obtaining your HS code, find out which federal agency regulates your product. For example:

- The FDA oversees food and drug imports.

- The EPA enforces environmental standards.

- The CPSC ensures consumer product safety.

- The USDA handles agricultural goods.

To get specific guidance, contact the port of entry where your shipment will arrive. They can explain the requirements for your products. Additionally, you can consult U.S. Customs and Border Protection (CBP) Centers of Excellence and Expertise, where import specialists can provide tailored advice.

"CBP recommends you speak with an import specialist at the CBP Centers of Excellence and Expertise before you import." - USA.gov

When preparing your entry forms, you’ll need an importer number. This is usually your IRS business registration number or Social Security number. If you don’t have one, you can apply for a CBP-assigned number using CBP Form 5106. Once you’ve determined the agency requirements, consider using compliance tools to double-check everything.

Step 3: Use Compliance Tools

There are several tools available to help verify compliance before your shipment arrives. For instance, the Bureau of Industry and Security (BIS) offers a Consolidated Screening List, which lets you check if any parties involved in your transaction are subject to trade restrictions. Additionally, the SNAP-R system allows for online submission of import and export license applications.

If you’re sourcing through Alibaba, ForthSource's Real-Time Landed Cost Calculator (available to Premium members) is particularly useful. It estimates shipping costs - whether by air, sea, or express - and includes import duties and compliance fees. This tool gives a full picture of your product’s total cost, including regulatory considerations, even before you contact the supplier.

For more complex shipments, such as those involving regulated goods like chemicals, electronics, or food, hiring a licensed customs broker is a smart move. They can handle the paperwork and ensure your shipment complies with all federal laws.

Best Practices for Compliant Alibaba Sourcing

Why Supplier Verification Matters

Choosing a verified supplier can help you avoid customs delays, shipment rejections, and compliance headaches. Recent trends show an increase in COO-related detentions globally, often due to incomplete declarations or unapproved issuing bodies. Many of these problems stem from suppliers who either lack proper documentation or misrepresent their qualifications.

On Alibaba, keep an eye out for the "Verified Supplier" badge. This label indicates that the supplier has successfully passed industry-recognized audits.

"A Certificate of Origin is not a receipt - it's a sworn statement with legal standing. Its validity hinges on who issues it, how it's completed, and whether it reflects the actual supply chain." - Priya Mehta, Partner, Global Trade Compliance Group

Ask for certification details to confirm compliance with required regulatory standards. Also, ensure that whoever signs key documents, like the Certificate of Origin, is an authorized representative - typically a director or someone registered with the chamber of commerce. This step is crucial to prevent document rejection. These verification measures are essential for ensuring smooth compliance.

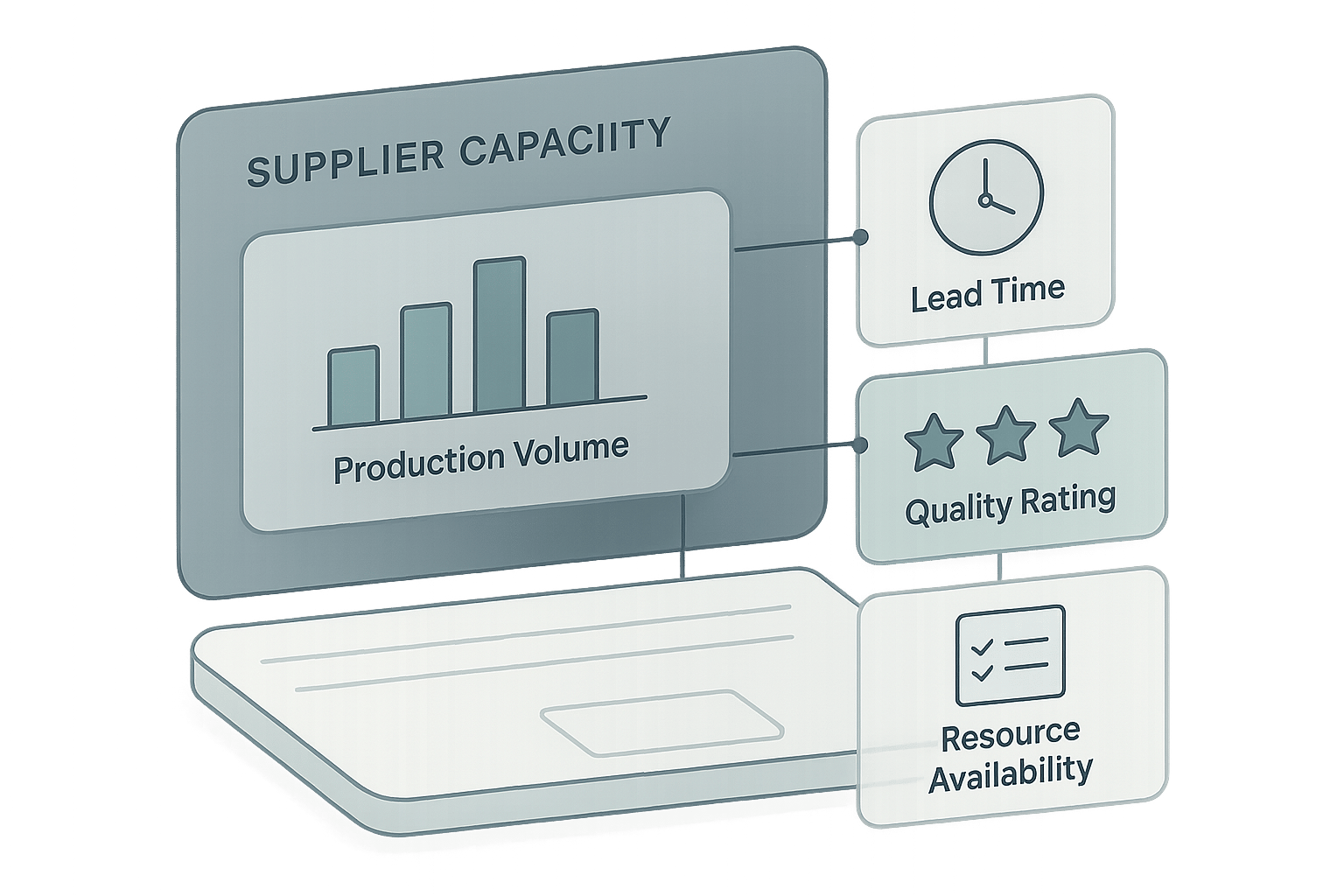

Using ForthSource for Licensing and Compliance

ForthSource simplifies supplier evaluation by assigning each one a Trust Score ranging from 0 to 100. This score is based on thousands of factors, such as verified licenses, transaction history, responsiveness, and customer feedback.

For Premium users ($29/month), the Real-Time Landed Cost Calculator is an invaluable tool. It estimates shipping costs - via air, sea, or express - along with import duties and taxes. This feature provides the true cost of your product, including regulatory fees, before you even contact a supplier. It’s especially helpful for regulated items, where compliance-related expenses can quickly add up.

Enterprise users ($99/month) get access to Baidu Intelligence Reports, which confirm a factory's legitimacy within China itself, not just its Alibaba profile. This extra layer of due diligence is critical for high-volume orders or sensitive goods like pharmaceuticals and chemicals. Once you’ve vetted your supplier, it’s time to prepare the necessary import documents.

Import Document Checklist

Having the right paperwork is key to avoiding storage fees or, worse, the seizure of your goods. Here are the essential documents you’ll need:

| Document | Purpose |

|---|---|

| Commercial Invoice | Confirms sale and valuation |

| Packing List | Details shipment contents |

| Certificate of Origin | Determines tariff eligibility |

| Bill of Lading (BOL) | Acts as a carriage contract/title |

| Import License/Permit | Required for regulated goods |

In the U.S., Customs and Border Protection (CBP) requires entry forms to be filed within 15 calendar days of a shipment arriving at a port of entry. Make sure all your documents align - HS codes, product descriptions, and addresses should match across the Commercial Invoice, Packing List, and Bill of Lading. Even a small error could result in delays or fines.

For shipments involving regulated goods, it’s wise to work with a licensed customs broker. They can manage the paperwork and ensure compliance with federal regulations.

"One small misstep - such as a typo or a misclassification - can lead to delays at customs, or worse, seizure of goods." - Hugo Pakula, CEO of Tru Identity

Conclusion

Key Points for U.S. Importers

For most products entering the U.S., you won’t need an import license. However, regulated items like food or hazardous materials require permits from specific federal agencies.

The first step is identifying your product's HS code - a six-to-ten-digit number that determines duty rates and specifies which federal agency oversees your item. With your HS code in hand, reach out to the appropriate agency or consult an import specialist at your CBP port of entry to confirm any additional requirements.

Equally important is ensuring your documentation is accurate. Commonly required documents include the Commercial Invoice, Packing List, Bill of Lading, and Certificate of Origin. It’s essential that all details match across these records. For high-value or complex shipments, working with a licensed customs broker can help you avoid unnecessary delays and costly errors. This extra step ensures your shipment process runs smoothly and aligns with all regulatory standards.

How ForthSource Helps Your Sourcing

ForthSource simplifies the sourcing process by connecting you with reliable factories using its verified Trust Score. Its Premium plan offers a Real-Time Landed Cost Calculator, while the Enterprise plan includes Baidu Intelligence Reports for in-depth supplier evaluation.

FAQs

How can I find out if my Alibaba product needs an import license?

To figure out whether your Alibaba product needs an import license, start by reviewing your country’s import rules. In the U.S., most imports require proper documentation, and certain items, like pharmaceuticals or medical devices, may need specific licenses or permits.

Check if your product falls into a regulated category, such as food, chemicals, or products with strict safety standards. If you’re uncertain, reach out to your country’s customs authority or trade department for clarification. You can also use tools like ForthSource for supplier insights, but remember, licensing requirements are always determined by government agencies.

What steps should I take to ensure my shipment meets U.S. customs requirements?

To navigate U.S. customs requirements effectively, you'll need a solid understanding of the customs clearance process and the right paperwork. The essential documents usually include a commercial invoice, bill of lading, and any required certificates, such as a certificate of origin or analysis, depending on the type of goods you're shipping. If you're dealing with items like food, pharmaceuticals, or medical supplies, you might also need an import license or specific permits to comply with U.S. regulations.

Staying up to date on tariffs, duties, and trade agreements that could affect your shipment is equally important. While many businesses turn to customs brokers to manage these complexities, having a basic grasp of the process empowers you to make better decisions and minimize delays. Ensuring that your documents are accurate, complete, and submitted on time is key to avoiding unnecessary hiccups and potential fines.

What are the advantages of working with a licensed customs broker for complex imports?

Using a licensed customs broker can make the import process much smoother, especially when dealing with complex shipments. These professionals handle the ever-changing maze of international trade regulations, ensuring all documentation is accurate, goods are properly classified, and paperwork is submitted on time to the right authorities. This helps minimize the chances of delays, fines, or penalties due to compliance issues.

Customs brokers also bring deep knowledge of tariffs, duties, and exemptions, which can uncover opportunities for cost savings. Their expertise in managing specialized procedures and working with multiple agencies ensures that shipments clear customs efficiently. By relying on their skills, you can save time, cut down on costs, and sidestep unnecessary headaches in your importing process.