A supplier quality scorecard helps you measure and improve supplier performance using clear metrics. It evaluates key areas like product quality, delivery reliability, pricing, and communication. By focusing on measurable data, you can identify reliable suppliers, reduce procurement costs by up to 15%, and improve lead times by 20%. Here's a quick guide:

- Start with Key Metrics: Track defect rates, compliance, on-time delivery, and cost consistency.

- Set Benchmarks: Use internal data, industry standards, and supplier agreements to define performance targets.

- Design a Scoring System: Assign weights to metrics (e.g., quality 40%, delivery 30%) and use a simple 1–5 scale or percentages.

- Collect and Verify Data: Use tools like ERP systems and feedback from teams to ensure accuracy.

- Review and Improve: Regularly analyze trends, collaborate with suppliers on improvement plans, and update metrics as needed.

How To Create A Supplier Scorecard

Choosing the Right Metrics for Supplier Evaluation

When it comes to supplier scorecards, picking the right metrics is absolutely essential. The focus should be on measurable indicators that directly influence your business goals. Start with just 2–3 critical metrics to avoid overwhelming yourself with data. Once you’ve nailed down the basics, you can always expand as needed to cover additional areas.

Core Quality Metrics

Quality metrics are the cornerstone of supplier evaluation. Let’s break down the key ones:

- Defect rate: This measures the percentage of products or services that fall short of your quality standards. A low defect rate (ideally under 2%) shows that a supplier has solid quality control practices in place, which is vital for keeping customers happy and reducing return costs.

- Compliance with specifications: This metric checks how well suppliers stick to your technical and quality requirements. It’s not just about the product working; it’s also about packaging, labeling, and meeting material standards. Poor compliance could point to communication gaps or capability issues.

- Return frequency: This tracks how often products are returned due to quality problems. High return rates often signal hidden defects or mismatched customer expectations, which can harm your reputation.

- Customer approval ratings: Feedback scores and reviews offer direct insight into how end users feel about the supplier’s products. If customer ratings are consistently low, it’s a red flag for recurring quality or service issues that need immediate attention.

Additional Performance Indicators

Beyond quality, there are other performance indicators that paint a broader picture of a supplier’s reliability and value:

- On-time delivery rates: Late deliveries can disrupt your supply chain and frustrate customers, so tracking this metric is crucial for maintaining smooth operations.

- Price consistency: Keep an eye on how quoted prices compare to actual costs. Frequent price changes or surprise fees can lead to budgeting headaches and financial uncertainty.

- Legal compliance: This ensures suppliers meet regulatory standards and maintain proper certifications, like safety protocols or industry-specific requirements. Up-to-date documentation is a must to reduce risks.

- Responsiveness and communication: How quickly and clearly your suppliers respond to inquiries can make or break your operations. Delayed or vague communication can lead to unnecessary bottlenecks.

| Metric Category | Example Metrics | Typical Target |

|---|---|---|

| Quality | Defect rate, compliance, returns | <2% defect rate, 98% compliance |

| Delivery | On-time rate, lead time accuracy | 95% on-time delivery |

| Cost | Cost variance, pricing consistency | <5% cost variance |

| Communication | Response time, issue resolution | <24-hour response time |

These metrics give you a comprehensive view of supplier performance, helping you establish benchmarks and refine scoring methods.

Data Collection and Verification

Accurate data collection is key to making informed decisions. Use multiple sources to gather reliable information:

- Procurement platforms and ERP systems: These tools track orders, deliveries, and payments automatically, capturing vital details like timestamps, quantities, and costs. They also minimize manual errors and flag discrepancies.

- Quality management systems: These systems monitor defects, compliance issues, and inspections in real-time, helping you spot patterns and trends that might otherwise go unnoticed.

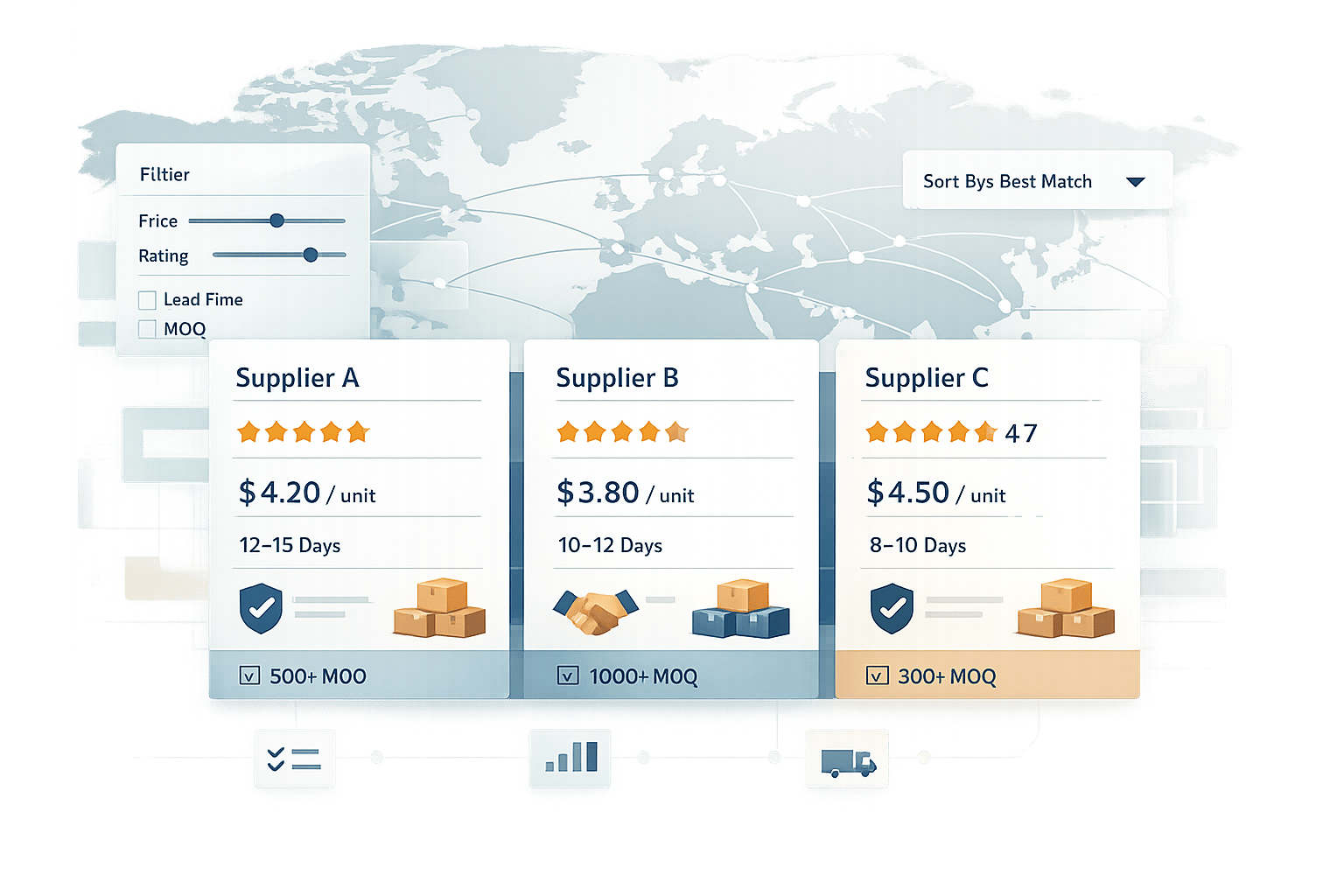

Modern tools like ForthSource take this a step further by consolidating supplier data from multiple sources. They use proprietary scoring methods based on factors like pricing, credibility, and even legal records, offering a more detailed supplier assessment.

To ensure data accuracy, use automated alerts to catch any red flags - like a sudden spike in defect rates or a drop in delivery performance. Regular audits and cross-checking data from multiple sources also help maintain reliability. And don’t just rely on numbers - feedback from your teams, such as receiving staff, quality inspectors, and customer service reps, can provide valuable insights that metrics alone might miss.

Setting Benchmarks and Scoring Methods

Once you've identified the key metrics for evaluating suppliers, the next step is to establish clear benchmarks and a scoring system. These tools help translate raw data into actionable insights, offering a structured way to assess supplier performance. Here's a breakdown of how to set benchmarks, create a scoring system, and combine quantitative data with qualitative feedback.

Creating Performance Benchmarks

To set effective benchmarks, you'll need to rely on three main resources: your internal data, industry standards, and supplier agreements.

Start by analyzing your historical performance data to establish a baseline. For instance, if your on-time delivery rate has averaged 87%, setting a benchmark of 90% creates a realistic yet challenging goal for suppliers.

Industry standards also provide valuable guidance. In sectors like electronics, companies often aim for on-time delivery rates of 95% or higher. Research metrics like defect rates, lead times, and other critical measures specific to your industry, then tailor them to fit your business priorities and supplier capabilities.

Lastly, use supplier agreements as natural benchmarks. For example, if a supplier has committed to keeping defect rates below 1.5%, that figure should automatically become your quality standard for that partnership.

According to McKinsey, companies with structured supplier performance management can cut procurement costs by 15% and improve lead times by 20%. When setting benchmarks, focus on what matters most to your business and customers. For example, if product quality is your highest priority, it may be worth setting stricter quality targets - even if it results in slightly higher costs or longer lead times. The goal is to ensure your benchmarks align with your business objectives and customer expectations.

Building a Scoring System

A scoring system helps standardize performance data, making it easier to compare suppliers. The most effective systems use weighted metrics that reflect your business priorities. For example, you might assign weights such as:

- Quality metrics: 40%

- Delivery performance: 30%

- Cost competitiveness: 20%

- Service: 10%

You can use a simple 1–5 rating scale, where higher scores indicate better performance, or percentage bands for more detailed assessments. For instance, scores of 90–100% could earn top marks, while anything below 70% signals a need for immediate attention.

| Scoring Method | Description | Best For | Example |

|---|---|---|---|

| 1–5 Scale | Simple rating system | Quick assessments | 5 = Excellent, 3 = Average, 1 = Poor |

| Percentage Bands | Performance ranges with scores | Detailed analysis | 90–100% = 5 points, 80–89% = 4 points |

| Weighted Average | Different weights for each metric | Complex evaluations | Quality 40%, Delivery 30%, Cost 20% |

Platforms like ForthSource take this a step further by aggregating data from multiple sources to create comprehensive supplier trust scores. These "data-backed trust scores" offer a more complete picture of supplier performance, going beyond traditional metrics.

Mixing Numbers with Feedback

While numerical scores are essential, they don't always tell the full story. To get a well-rounded view of supplier performance, integrate qualitative feedback into your scoring system. Add comment sections where team members can share observations on supplier responsiveness, problem-solving, and communication.

Input from various stakeholders is invaluable. For example, your receiving team might notice improvements in packaging that aren't reflected in defect rates, while customer service reps might highlight how supplier delays impact customer satisfaction. This type of feedback captures nuances that raw numbers might overlook.

External sentiment data can also provide additional context. Review platforms, social media mentions, and other public data sources can reveal insights into a supplier's reputation or potential issues. Tools like ForthSource's Built-in Sentiment Signals incorporate this type of data, giving you a more rounded view of supplier trustworthiness.

Finally, consider automating alerts within your scoring system to flag performance changes. For instance, if a supplier's quality score drops significantly - say from 4.2 to 3.1 over two months - your system should notify the appropriate team members. This allows you to address potential problems before they escalate and disrupt your operations.

sbb-itb-633367f

Creating and Using the Scorecard

Once you've defined your metrics and set up a scoring system, the next step is to create a scorecard that your team can actually use. The goal is to design something that's easy to navigate while still covering all the necessary details. And before rolling it out to all your suppliers, make sure to test it thoroughly.

Designing a Clear Scorecard Layout

A well-designed scorecard should provide clear insights without overwhelming the user. At a minimum, it should include supplier details (like name, contact information, and product or service category), key performance indicators (KPIs), numerical scores, and a section for qualitative feedback.

Most teams find that a spreadsheet format works best. Suppliers are listed in rows, while metrics are laid out in columns. This structure makes it easy to compare suppliers side by side. Be sure to include columns for each weighted metric - such as quality, delivery, cost, and service - and an overall score that updates automatically based on the weights you’ve assigned.

Color coding can further simplify the process. For example:

- Green for top-performing suppliers

- Yellow for average scores

- Red for areas that need improvement

This visual approach makes it easy to spot trends or problem areas at a glance.

For teams looking for more advanced tools, platforms like Tableau or Power BI can take things to the next level. These tools can generate dashboards, trend charts, and comparative reports automatically, saving time and providing deeper insights than a manual spreadsheet.

| Essential Scorecard Elements | Description |

|---|---|

| Supplier Details | Name, contact info, product/service category |

| KPIs | Metrics like quality, delivery, cost, responsiveness |

| Scores & Weightings | Numeric ratings with assigned importance levels |

| Trend Analysis | Performance tracked over time (monthly, quarterly, etc.) |

| Comments | Notes on performance and areas for improvement |

| Action Plans | Agreed corrective actions with deadlines |

Once your layout is ready, the next step is to test it with a small group of suppliers to ensure it works as intended.

Testing and Improving the Scorecard

Before deploying the scorecard widely, run a pilot test with a select group of suppliers. This step is crucial for identifying any flaws in the design and ensuring the metrics provide meaningful insights.

During the pilot phase, gather feedback from your team to confirm that the evaluation criteria are clear and the data collection process is manageable. Pay attention to any confusing metrics or overly complicated steps.

It's also important to cross-check the scorecard results with real-world business outcomes. For instance, if a supplier scores high on delivery but your operations team reports frequent delays, you may need to revisit your metrics or improve how data is being collected.

"We cut sourcing time by 40% using ForthSource's scoring system. Game changer." – Alex Chan, Supply Lead at Luma Goods

Use the feedback from this pilot to fine-tune your scorecard. This might mean redefining certain metrics, adjusting weightings, or simplifying the data entry process. The end goal is to create a tool that accurately reflects supplier performance while being practical for everyday use.

Setting Up Regular Reviews

After refining your scorecard, establish a routine for reviewing it to ensure it stays relevant. Supplier performance can change over time, so regular updates are essential. Quarterly reviews work well for most businesses, but for critical or high-risk suppliers, more frequent evaluations may be necessary.

When conducting reviews, focus on trends rather than just current scores. For example, a steady decline in a supplier's performance could indicate potential issues that need to be addressed early.

Bring in multiple stakeholders for these reviews. Procurement can provide insights on costs and contracts, quality control can share defect rates, and operations can report on delivery performance. This collaborative approach gives you a well-rounded view of each supplier's role in your business.

Share the scorecard results with your suppliers during review meetings. Discuss trends, highlight areas for improvement, and work together to set clear goals. This transparency not only strengthens relationships but also helps drive performance improvements.

To stay proactive, consider setting up automated alerts to flag major performance changes between review periods. This ensures that issues are addressed promptly.

Finally, document any action plans and track progress consistently. Regular follow-ups help ensure that commitments are met and that the scorecard remains a tool for driving meaningful improvements. By sticking to a regular review cycle, your scorecard can adapt to meet the evolving needs of your business.

Using Results to Improve Supplier Performance

The true value of a supplier scorecard lies in its ability to transform raw data into meaningful improvements. By interpreting the results effectively, collaborating with suppliers on targeted plans, and keeping the scorecard aligned with your evolving business needs, you can strengthen partnerships and enhance overall performance.

Reading Scorecard Results

To get the most out of your scorecard data, start by comparing each supplier's performance metrics - like quality, delivery, cost, and responsiveness - against your established benchmarks. Top-performing suppliers consistently meet or exceed these standards, while underperformers may struggle in critical areas such as defect rates or on-time delivery.

Visual tools, like color-coded dashboards and trend charts, simplify this process by highlighting patterns and anomalies. For instance, a supplier with consistent green scores across all metrics clearly stands out as a reliable partner. On the other hand, multiple red flags signal areas that require immediate attention.

Tracking performance trends over time is equally important. A supplier whose performance has been slipping over several quarters might be facing underlying issues, even if their current scores are still acceptable. Conversely, suppliers showing steady improvement deserve acknowledgment and may even warrant expanded business opportunities.

To get a well-rounded view, involve various departments in the review process. Procurement teams can assess cost and contract performance, quality control can provide defect data, and operations teams can evaluate delivery reliability. This collaborative approach ensures no critical insights are overlooked.

Modern systems can go even further, offering insights into pricing accuracy, data completeness, domain reputation, and verified reviews. Use this information as the foundation for constructive discussions and improvement plans.

Working with Suppliers on Improvements

Once you've analyzed the results, the next step is to work collaboratively with suppliers to address any shortcomings. Schedule regular review meetings to discuss strengths and areas for improvement, using specific examples from the scorecard data.

Approach these sessions as opportunities for problem-solving. For example, if a supplier's on-time delivery rate is below target, work together to identify the root causes. The issue could stem from logistics challenges, capacity limitations, or communication gaps that you can help resolve.

Develop clear improvement plans with measurable goals and set timelines. For instance, if quality issues are a concern, the plan might include process audits, additional quality checks, and monthly progress reviews. Ensure both parties understand their roles and commit to regular follow-ups to track progress.

Recognition is another powerful motivator. Celebrate high-performing suppliers with awards, preferred supplier status, or additional business opportunities. Public acknowledgment, whether during review meetings or in company communications, can inspire suppliers to maintain or improve their performance.

"We cut sourcing time by 40% using ForthSource's scoring system. Game changer." – Alex Chan, Supply Lead at Luma Goods

Document all improvement plans to ensure accountability and reinforce commitment. Regular follow-ups not only keep the momentum going but also demonstrate your dedication to the partnership.

Updating Your Scorecards Over Time

A supplier scorecard should never be a static tool. As your business evolves, your scorecard must adapt to reflect new priorities, market conditions, and industry changes. Regularly reviewing and updating your scorecard ensures it remains relevant and effective.

Conduct annual reviews - or more frequent ones during major business shifts - to reassess metrics, benchmarks, and priorities. Gather feedback from internal stakeholders and suppliers to determine if the current scorecard aligns with your goals. This input can help you refine metrics, adjust weightings, or add new requirements.

Historical performance data can also guide updates. For example, if most suppliers consistently exceed a benchmark, it might be time to raise the standard. On the flip side, if very few suppliers meet a specific requirement, consider whether it's realistic or needs adjustment.

Keep an eye on industry trends like regulatory changes, technological advancements, or market shifts. These factors might necessitate new metrics or scoring methods. Staying informed ensures your scorecard reflects current realities.

When updating your scorecard, communicate changes clearly to all suppliers. Explain why the updates are being made and give them enough time to adapt. This transparency fosters trust and ensures everyone is on the same page.

Finally, use your scorecard data to make informed sourcing decisions. High-performing suppliers may deserve expanded partnerships or preferred status, while underperformers might require intensive support - or, in extreme cases, replacement. By relying on data-driven insights, you can optimize your supplier base, reduce risks, and strengthen your supply chain.

The ultimate goal is to maintain a dynamic tool that evolves alongside your business while continuing to drive supplier performance and excellence. Regular updates ensure the scorecard remains a valuable resource for years to come.

Conclusion and Key Takeaways

A well-designed supplier quality scorecard transforms sourcing into a data-driven process. By focusing on key steps - choosing the right metrics, setting clear benchmarks, creating transparent scoring systems, and consistently reviewing performance - you can build a tool that strengthens supplier relationships and minimizes operational risks.

The impact of structured scorecards is clear. For example, a major electronics manufacturer reduced supply chain disruptions by 30% after introducing automated supplier scorecards that monitored factors like quality, delivery times, and responsiveness.

As your business evolves, your scorecard should, too. Begin with 5–10 essential KPIs - such as on-time delivery, product quality, and cost stability - and adjust these metrics over time based on performance insights and feedback from stakeholders. Regular updates ensure your scorecard stays relevant to shifting market dynamics and business goals.

The most effective scorecards combine hard data with direct feedback, offering a complete picture of supplier performance. This balanced approach supports decisions to strengthen partnerships with top-performing suppliers, address underperformance, and reduce risks.

To simplify the process, consider using platforms like ForthSource. By consolidating supplier data from over 50 sources and applying advanced scoring systems based on pricing, credibility, and quality, ForthSource eliminates much of the manual effort traditionally required. Its real-time analytics and cross-platform comparisons provide the solid data foundation needed to make supplier scorecards a success.

FAQs

What key metrics should you include in a supplier quality scorecard, and why do they matter?

When designing a supplier quality scorecard, it's crucial to focus on metrics that genuinely measure supplier performance, dependability, and overall contribution to your business. Some of the key metrics to evaluate include:

- On-time delivery rates: Are suppliers consistently meeting deadlines?

- Product quality consistency: Do the goods or services meet your quality expectations every time?

- Pricing competitiveness: Are their prices fair and aligned with market standards?

- Responsiveness to communication: How quickly and effectively do they address inquiries or issues?

These elements are essential for ensuring suppliers align with your expectations and operational goals.

For those looking to adopt a more analytical approach, platforms like ForthSource offer advanced scoring systems. These tools evaluate suppliers using factors such as credibility, pricing, and real-time data insights. This not only helps pinpoint reliable partners but also minimizes potential sourcing risks. By focusing on the right metrics, you can make well-informed decisions and cultivate stronger, more effective supplier relationships.

How can companies balance qualitative feedback with quantitative data in a supplier quality scorecard?

To create a well-rounded supplier quality scorecard, it's important to blend quantitative metrics - like pricing, delivery accuracy, and defect rates - with qualitative factors such as communication effectiveness and responsiveness. This mix provides a comprehensive view of supplier performance.

Tools like ForthSource make this process easier by leveraging intelligent scoring systems that pull in real-time data. These systems evaluate aspects like pricing, reliability, and even sentiment analysis. By combining hard data with subjective feedback, businesses can make more informed, data-driven sourcing decisions.

What are the best practices for collecting accurate and reliable data for a supplier quality scorecard?

To build a supplier quality scorecard that delivers accurate and trustworthy results, it's essential to use a structured scoring system. This system should evaluate critical factors like pricing, reliability, and product quality. Incorporating real-time data and verified metrics ensures that your evaluations remain precise and dependable.

You can also enhance your scorecard by leveraging tools that pull in trust signals, such as verified reviews or legal reports. These insights provide a fuller picture of a supplier's performance, helping you make smarter, data-backed decisions and reducing potential risks in your sourcing process.