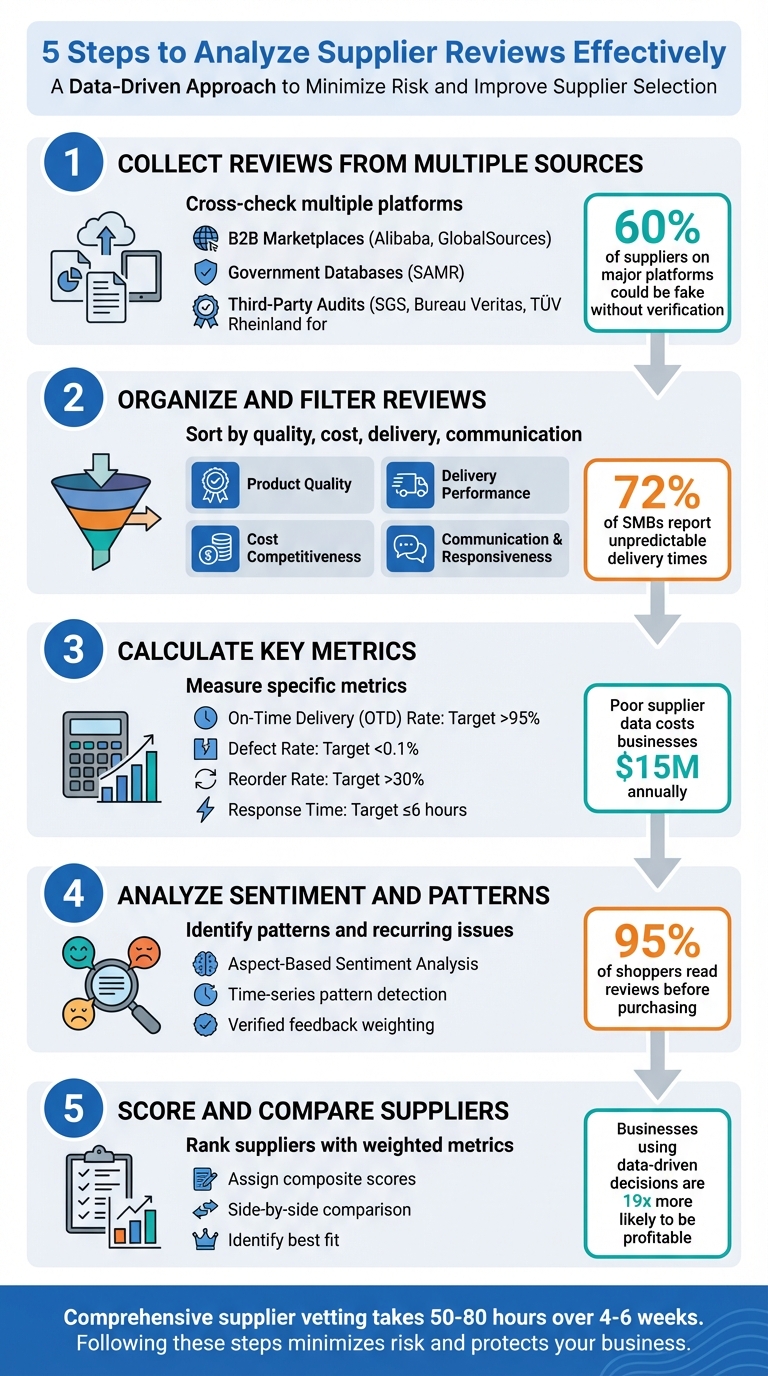

Choosing the wrong supplier can cost your business time, money, and reputation. Here's how you can analyze supplier reviews to make better decisions, avoid risks, and improve reliability:

- Collect Reviews from Multiple Sources: Use platforms like Alibaba, GlobalSources, and third-party audits to cross-check supplier data and verify legitimacy.

- Organize and Filter Reviews: Categorize reviews by key factors like quality, delivery, cost, and communication. Filter out irrelevant or fake feedback.

- Calculate Key Metrics: Focus on measurable data like defect rates, on-time delivery, and reorder rates to quantify supplier performance.

- Analyze Sentiment and Patterns: Look beyond ratings to understand recurring issues and customer sentiment tied to specific supplier behaviors.

- Score and Compare Suppliers: Use composite scores based on weighted metrics to compare suppliers side-by-side and identify the best fit.

Key Insight: Businesses lose billions annually due to unreliable suppliers. By applying these steps, you can minimize risks and make smarter sourcing decisions.

Quick Comparison Table:

| Step | Key Action | Tools/Resources |

|---|---|---|

| Collect Reviews | Cross-check multiple platforms | Alibaba, SGS, TÜV Rheinland |

| Organize and Filter | Sort by quality, cost, delivery, communication | Verified purchase tags, filters |

| Calculate Metrics | Measure defect rates, OTD, reorder rates | Comparison tables |

| Analyze Sentiment | Identify patterns and recurring issues | Sentiment analysis tools |

| Score and Compare | Rank suppliers with weighted metrics | Composite scoring systems |

Avoiding supplier mistakes isn’t optional - it’s essential for protecting your brand and profits. These steps provide a structured, data-driven approach to supplier review analysis.

5-Step Process for Analyzing Supplier Reviews Effectively

Supplier Relationship Scorecard Template | Assess Supplier Performance Like a Pro

Step 1: Collect Reviews from Multiple Sources

Relying on just one platform for supplier reviews can leave you with an incomplete picture. For example, in a survey of 109 buyers, 33% admitted they don't trust Alibaba suppliers, and experienced sourcing professionals estimate that over 60% of suppliers listed on major platforms could be "fake or fraud" without proper verification. To avoid these pitfalls, it's crucial to gather data from multiple sources to ensure the reviews you rely on are more reliable and well-rounded.

Identify Key Review Sources

To start, gather reviews from a variety of sources. Look at B2B marketplaces like Alibaba, GlobalSources, and Made-in-China, which use trust indicators such as "Gold Supplier" or "Verified Supplier" badges. Then, cross-check this information with government databases like the SAMR or the National Enterprise Credit Information Publicity System, as well as third-party audits from organizations like SGS, Bureau Veritas, TÜV Rheinland, and Intertek. These steps help verify supplier legitimacy beyond what a single platform can offer. Additionally, direct communication channels like WeChat or Alibaba Trade Manager can provide insights into how responsive and reliable a supplier might be.

Why go to all this trouble? Because reviews on a single platform can sometimes be manipulated. As Matt Slater from China Checkup explains:

"The prevalent attitude is 'Get the order first, figure out how to make it later!'"

By cross-referencing multiple sources, you can identify genuine manufacturers and avoid trading companies pretending to be factories. This process also helps address the "sample gap", where initial samples appear flawless, but bulk production doesn't meet the same standard. Comprehensive supplier vetting often takes 50 to 80 hours spread over 4 to 6 weeks, which underscores the importance of aggregating data to save time and improve accuracy.

Use ForthSource for Aggregated Data

Switching between platforms and spreadsheets can be time-consuming and inefficient. This is where ForthSource comes in. The platform consolidates real-time data from sources like Alibaba, WeChat interactions, and legal records into one easy-to-use dashboard. It employs a proprietary scoring system that evaluates factors like pricing, credibility, WeChat activity, and legal standing - giving you actionable insights without the hassle.

While third-party inspection fees typically account for just 1–3% of the total order value, using an aggregation tool like ForthSource can save you significant time and effort. By catching potential issues early, it ensures you can make quicker, more informed decisions, all while focusing on the data that matters most.

Step 2: Organize and Filter Reviews

After gathering reviews from various sources, the next step is to make sense of all that data. Without a clear system, it’s easy to get lost in irrelevant details. As Netstock aptly puts it, "Your supply chain is only as strong as its weakest link, yet your business depends heavily on its performance". To avoid this, you need to organize reviews into specific performance categories and apply filters that highlight the most useful insights.

Sort Reviews by Key Criteria

Start by dividing reviews into four main categories: Product Quality, Delivery Performance, Cost Competitiveness, and Communication & Responsiveness.

For product quality, pay attention to mentions of defect rates, return rates, and compliance with technical standards like ISO 9001. When it comes to delivery performance, focus on metrics like On-Time Delivery (OTD) rates and lead time consistency. These are crucial, especially since 72% of small-to-medium businesses report unpredictable delivery times, and 67% of companies sourcing from China experience variability in lead times.

Cost evaluation shouldn’t stop at unit prices. Instead, calculate the Total Cost of Ownership (TCO), which includes hidden costs like shipping, customs duties, storage, and quality control. A supplier with a lower unit price might end up costing more when you factor in high defect rates or unexpected fees. Communication is another critical area - look for quick response times (ideally under six hours), transparency, and flexibility in handling demand changes.

Apply Filters for Relevance

Review data often contains noise - fraudulent feedback, outdated comments, or irrelevant information. Start by filtering for verified buyers only. Prioritize platforms that use "Verified Purchase" tags or secure transaction systems like Trade Assurance. Be wary of overly positive reviews with repetitive language, as they may indicate fake feedback. For instance, in August 2020, Amazon UK removed 20,000 reviews after a Financial Times investigation uncovered incentivized feedback through Facebook groups.

Use tools like verified purchase tags, recency filters (reviews from the last 6–12 months), and numerical benchmarks to ensure relevance. For example, focus on suppliers with an OTD rate above 95%, reorder rates over 30%, and response times under six hours. Keep in mind that supplier performance can change quickly due to factors like management shifts, equipment upgrades, or geopolitical events. A glowing five-star review from three years ago might not reflect current realities.

Additionally, filter by certification status. Suppliers with ISO 9001 (quality management) or ISO 14001 (environmental management) certifications meet international standards and are often more reliable.

For example, Sichuan Rongheyu Trading Co. has a 4.6/5 rating but boasts a strong 41% reorder rate, indicating high client loyalty. On the other hand, Yiwu Sunshine Trade Co., Ltd. holds a higher 4.9/5 rating but only a 19% reorder rate. These filters help identify which supplier truly satisfies its customers over time.

Step 3: Calculate Review Metrics

Turn subjective reviews into measurable data. Metrics provide clear, objective benchmarks to evaluate and compare suppliers effectively.

"Your suppliers aren't just vendors sending you stuff - they're partners who can make or break your business." - esgrid.com

The next step is identifying the key metrics that directly influence your operations.

Define Key Metrics for Analysis

These metrics help quantify supplier performance based on earlier insights. Start with five essential metrics:

- Customer Satisfaction (CSAT): Calculate the average rating by dividing the number of 4 or 5 ratings by the total responses, then multiply by 100. Alternatively, sum all ratings and divide by the total number of reviews.

- On-Time Delivery (OTD) Rate: Use the formula (on-time deliveries ÷ total deliveries) × 100. A rate above 95% signals reliability, while anything below could indicate issues. For context, 72% of small and medium-sized businesses already face challenges with delivery delays.

- Defect Rate: Calculate this as (defective items ÷ total items received) × 100. Consider the case of Mattel in 2007, when a recall of 18 million toys due to lead paint and magnet hazards cost the company $30 million and hurt its stock value. A simple defect rate calculation could have flagged these issues earlier.

- Lead Time Variance: Measure the difference between actual and expected lead times to identify supply chain unpredictability.

- Reorder Rate: Determine this as (repeat customers ÷ total customers) × 100. This metric reflects long-term trust. For instance, Dezhou JM Import & Export Co., Ltd. boasts a 5.0/5.0 rating on Alibaba, a 24% reorder rate, over $170,000 in verified transactions, and a response time of less than 4 hours.

"Stick to 5-10 metrics that directly affect your business. Too many metrics dilute focus. Each one should lead to action - if you can't act on it, don't measure it." - esgrid.com

Use Comparison Tables for Insights

Once you’ve calculated your metrics, organize them into a comparison table for side-by-side analysis. The table should include metric names, scores, target thresholds, and supplier rankings. This format helps you quickly identify top performers and flag underperformers. Set clear thresholds before diving into the data - for example, aim for an OTD rate above 95%, a defect rate below 0.1%, and a reorder rate higher than 30%.

Here’s an example of how to structure your table:

| Metric Name | Target Threshold | Supplier A | Supplier B | Supplier C |

|---|---|---|---|---|

| Average Rating | ≥4.5/5.0 | 4.9 | 4.6 | 5.0 |

| On-Time Delivery Rate | >95% | 97% | 89% | 98% |

| Defect Rate | <0.1% | 0.05% | 0.15% | 0.03% |

| Lead Time Variance | ±2 days | +1 day | +5 days | 0 days |

| Reorder Rate | >30% | 19% | 41% | 24% |

| Response Time | ≤6 hours | 4 hrs | 3 hrs | 4 hrs |

In this example, Supplier C stands out as the overall best performer, but Supplier B’s 41% reorder rate highlights strong customer loyalty despite a slightly lower average rating. These nuances become clear only when metrics are organized systematically. Accurate calculations and comparisons are essential for making informed decisions.

sbb-itb-633367f

Step 4: Analyze Sentiment and Identify Patterns

Numbers tell you what happened; sentiment analysis helps explain why. This step turns scattered opinions into a clear story about supplier performance.

Analyze Sentiment in Review Content

Aspect-Based Sentiment Analysis (ABSA) digs deeper than simple star ratings. It connects emotional cues to specific supplier features and identifies whether feedback is positive, negative, or neutral - and how strongly it leans in one direction. Instead of just seeing a 4.2-star rating, you can uncover specific strengths like "excellent build quality" or weaknesses such as "slow shipping speed".

For example, a review saying "packaging was damaged" doesn’t carry the same weight as one stating "packaging was completely destroyed". Reviews matter - 95% of shoppers read them before making a purchase, and 82% actively look for negative ones to gauge credibility.

"A single negative review is not a crisis; a pattern of negative reviews about the same issue is." - 42Signals

Once sentiment scores are clear, the next step is to uncover recurring themes.

Detect Patterns and Recurring Issues

Organizing feedback into categories makes it easier to connect recurring issues directly to supplier performance. For instance, grouping terms like "lag", "slow", and "boot time" under a theme like "Performance" can highlight broader problems. A real-world example: In September 2024, a holiday park company using Feefo noticed repeated complaints about "shadiness" in reviews. Upon investigation, they found all these issues tied to one specific villa, allowing them to act quickly.

Using time-series analysis can further enhance this process. For example, a spike in "delivery time" complaints might align with a change in logistics partners or the release of a new product batch. Businesses that rely on this type of data-driven decision-making are 19 times more likely to achieve profitability.

Use ForthSource's Credibility Insights

To round out your analysis, integrate credibility insights. ForthSource adds an extra layer by weighting verified feedback, ensuring sentiment trends reflect genuine customer experiences. The platform uses domain trust metrics to separate valid concerns from outlier complaints. This verified-only approach minimizes the risk of fake reviews skewing your analysis.

For instance, if ForthSource flags a supplier with competitive pricing but poor domain credibility, you can cross-check this with sentiment patterns. If reviews frequently mention "unresponsive communication" or "missing documentation", the credibility score backs up what customers are reporting. Combining these quantitative and qualitative insights gives you a well-rounded view of supplier reliability.

Step 5: Score and Compare Suppliers

After conducting sentiment analysis, the next step is to translate your findings into composite scores. These scores provide a clear way to compare suppliers and pinpoint which ones are worth your investment.

Assign Composite Scores

A composite score merges measurable data - like On-Time Delivery (OTD) rates and defect percentages - with qualitative feedback from sentiment analysis. Start by identifying 5–10 key metrics that are most crucial to your business. These might include OTD, Total Cost of Ownership (TCO), communication responsiveness, and defect rates. Then, assign weights to each metric based on its importance to your operations. To calculate a supplier’s composite score, multiply their performance in each metric by the assigned weight and sum up the results.

For example, a supplier with a 98% OTD rate and positive feedback on "flexibility" will score higher than one with a 92% OTD rate and frequent complaints about "unresponsive communication". It’s worth noting that 87% of procurement professionals now prioritize managing supplier risk, as poor supplier data can cost businesses an average of $15 million annually.

"Your supply chain is only as strong as its weakest link, yet your business depends heavily on its performance." - Netstock

These composite scores help you compare suppliers systematically, highlighting the trade-offs that matter most to your business.

Use Side-by-Side Comparisons

Arranging suppliers side-by-side makes it easier to evaluate trade-offs. For example, Shenzhen New Gaopin Sports Goods Co., Ltd. achieved a perfect 100% OTD rate with response times under two hours, while Nantong Teamforce Sports had a slightly lower 93.9% OTD rate but boasted a 46% reorder rate - indicating high customer satisfaction despite occasional delays. In some cases, paying a 5–10% price premium can be a smart move to avoid costly delays or defective shipments.

Tools like ForthSource simplify this process by offering side-by-side comparison features. These tools allow you to filter suppliers based on criteria like response time, OTD benchmarks, and reorder rates. Instead of manually crunching numbers in spreadsheets, you can quickly identify which suppliers meet your OTD target of 95% or higher and which ones fall short. This ensures your sourcing decisions are grounded in reliable, real-time data.

Conclusion

Examining supplier reviews provides a structured way to guard against expensive supplier mistakes. By gathering reviews from various sources, using filters to organize them, calculating clear metrics, analyzing sentiment trends, and comparing suppliers side-by-side, you turn sourcing into a data-driven process instead of relying on guesswork. This method lays a strong foundation for managing risks effectively.

Take Mattel in 2007, for instance - poor supplier vetting led to a $30 million loss. Similarly, in early 2024, Samsung SDI faced production issues due to non-compliance. These cases highlight a critical truth: "Vetting your overseas supplier isn't optional in 2025 - it's your best defense against lost profits, bad reviews, and account suspensions", as Lisa J from Seller Labs explains.

By following these steps, you minimize operational risks, ensure compliance, and strengthen your supply chain. The key is using objective metrics to guide your choices. It’s a small investment - inspection fees typically range from just 1–3% of the total order value - but it can prevent costly returns and lost sales.

Using a centralized platform takes this process a step further, turning metrics into actionable insights. Tools like ForthSource speed up the process by consolidating data, applying composite scoring, and offering transparent supplier comparisons. Instead of scouring multiple platforms for reviews, you get real-time access to verified supplier information and quality signals all in one place. This means quicker vetting, smarter sourcing decisions, and fewer surprises when your shipment arrives.

As Sourcify puts it, "Sourcing done right is a competitive advantage". Analyzing supplier reviews doesn’t just manage risks - it gives you an edge in the marketplace.

FAQs

What’s the best way to spot fake supplier reviews?

When trying to spot fake supplier reviews, keep an eye out for a few telltale signs. Start by checking for generic or incomplete reviewer profiles - these often lack personal details or seem oddly vague. Also, pay attention to the absence of verified-purchase badges, which can indicate that the reviewer may not have actually used the product or service. Another red flag is overly enthusiastic or repetitive language that feels more like a sales pitch than an honest opinion.

Additionally, be wary of reviews with identical wording appearing across different platforms. Unusual posting patterns, such as a sudden flood of reviews in a short period, can also signal something fishy. Keeping these clues in mind can help you better evaluate the reliability of reviews and make smarter choices.

What are the key factors to consider when evaluating a supplier?

When choosing a supplier, it's important to weigh a few key factors to ensure you're partnering with someone reliable and capable of delivering quality. Here's what to consider:

- Product quality: Check metrics like defect rates and return rates, and take note of customer feedback about the supplier's products. Consistent quality is non-negotiable.

- Delivery performance: Evaluate how well the supplier sticks to promised lead times and whether they deliver orders on schedule. Timely delivery can make or break your operations.

- Cost competitiveness: Compare their pricing with market norms. The goal is to find a balance - fair prices without cutting corners on quality.

- Compliance: Ensure the supplier holds the required certifications and follows all relevant regulations. This protects your business from potential legal or operational issues.

- Risk management: Look into their financial stability and how they handle sensitive matters like intellectual property. A supplier's ability to navigate risks can affect their reliability in the long run.

By keeping these factors in mind, you'll be better equipped to make smart supplier choices and avoid unnecessary complications.

How can sentiment analysis provide deeper insights into supplier reviews?

Sentiment analysis takes supplier reviews beyond basic star ratings by breaking down the language into actionable insights. It categorizes feedback as positive, negative, or neutral, while also diving into specific areas like product quality, delivery times, and customer service.

By identifying patterns and uncovering potential issues, sentiment analysis provides sourcing managers with a deeper look at a supplier’s reliability and performance. This added clarity helps in making smarter, well-informed decisions.